Leverage Published Its First IFRS S2 Carbon Neutrality Roadmap Action Report

On August 9, 2023, Leverage released the 2022 Carbon Neutrality Roadmap Action Report. This report is Leverage's first carbon neutrality roadmap action report based on IFRS S2 standards, aiming to incorporate climate issues into corporate governance and business strategy, promote the dual track of risk and opportunity, add climate risk to the existing risk management system, combine with green services, and find new development opportunities. This is our second Carbon Neutral Roadmap Action report, and Leverage will publish reports on its climate actions on a regular basis every year.

The report is being released pursuant to the Financial Stability Board's (FSB) Task Force on Climate-related Financial Disco-Sures, TCFD and IFRS S2 Climate-related Disclosures recommended disclosure frameworks based on four disclosure recommendations: governance, strategy, risk management, and indicators and targets. Demonstrate Leverage on climate resilience and external influence in the face of climate change challenges.

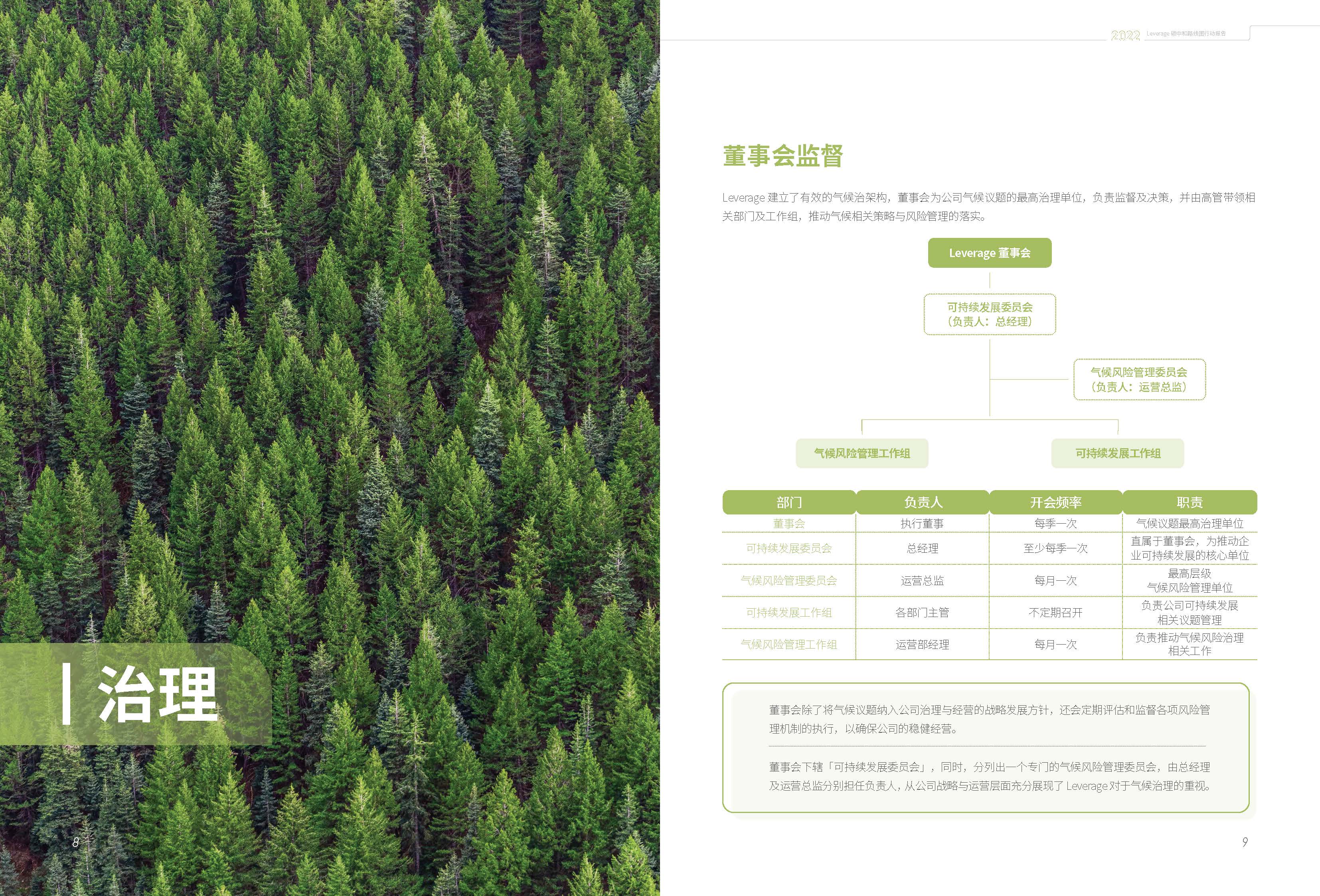

Leverage has established an effective climate governance structure, with a board of directors as the company's highest governance unit on climate issues, responsible for oversight and decision-making, and senior management led relevant departments and working groups to drive the implementation of climate-related strategies and risk management.

Leverage's climate governance related management divisions included the Climate Risk Management Working Group and the Sustainability Working Group, each reporting progress and effectiveness to the Board's Sustainability Committee.

In order to strengthen the company's internal governance on climate-related issues and establish formal targets and standards for each process, the ESG Sustainability Management Process had been developed with reference to relevant sustainability guidelines and guidelines to implement the key principles of sustainability for the company. It covered a wide range of environmental, social, governance and climate change issues to promote the implementation of sustainable development strategies.

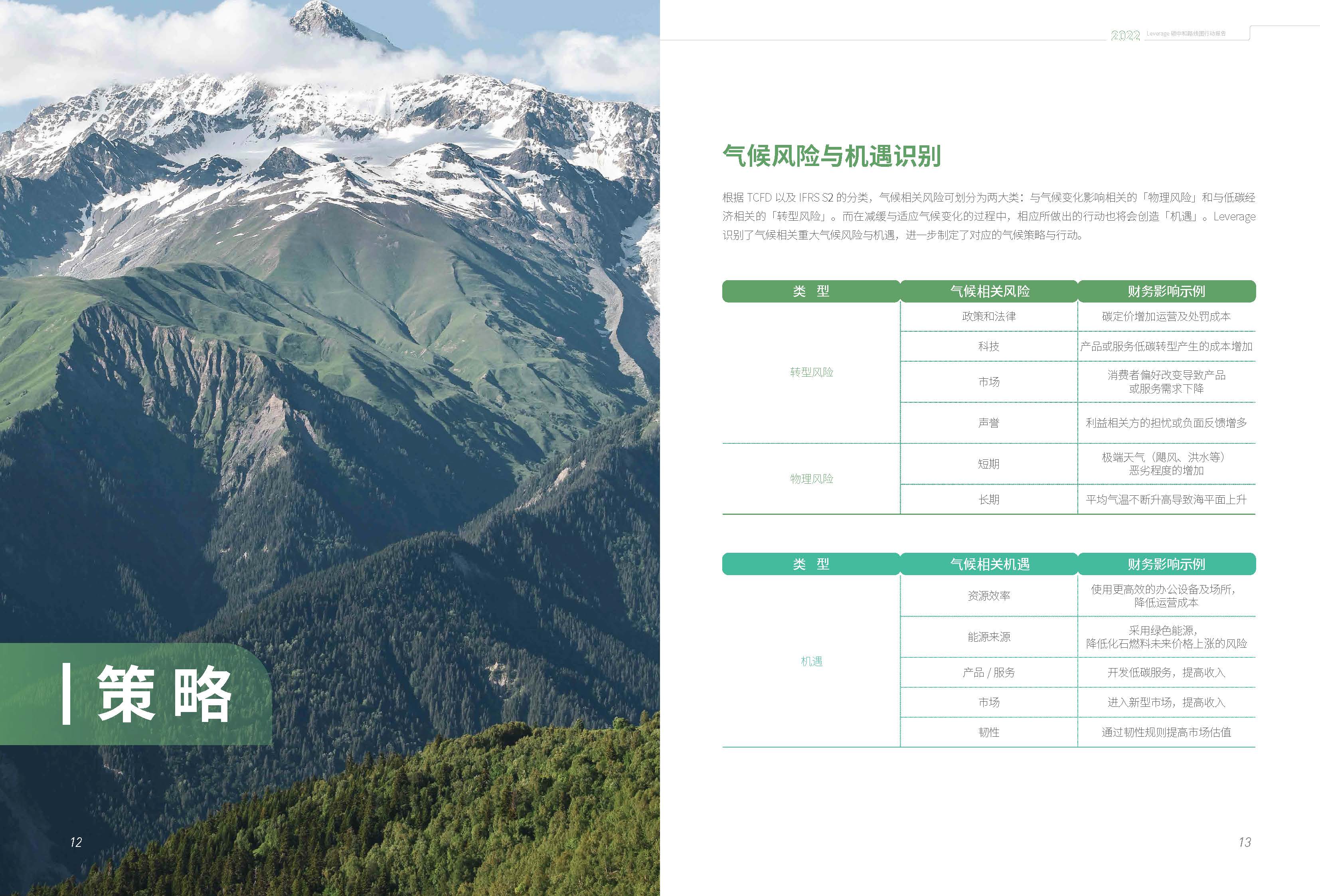

According to the TCFD and IFRS S2 classification, climate-related risks could be divided into two broad categories: physical risks associated with the impacts of climate change and transition risks associated with a low-carbon economy. Action would also create opportunities in mitigating and adapting to climate change. Leverage identified major climate-related climate risks and opportunities, further formulates corresponding climate strategies and actions.

Leverage actively participates in major regional and international climate-related action initiatives or alliances in Asia every year. We hope to introduce international resources to assist Leverage in climate change governance, while also sharing Leverage governance experience with the international community and actively speaking out for China's contribution to climate action.

Leverage recognizes that clear identification of climate change-related risks and opportunities and their potential impact on our business, strategic and financial planning is critical to our response to the challenge of climate change. Therefore, we conducted a scenario analysis of future climate change, and based on the scenario analysis results, comprehensively assessed the resilience level of the company's operations in adapting to climate change.

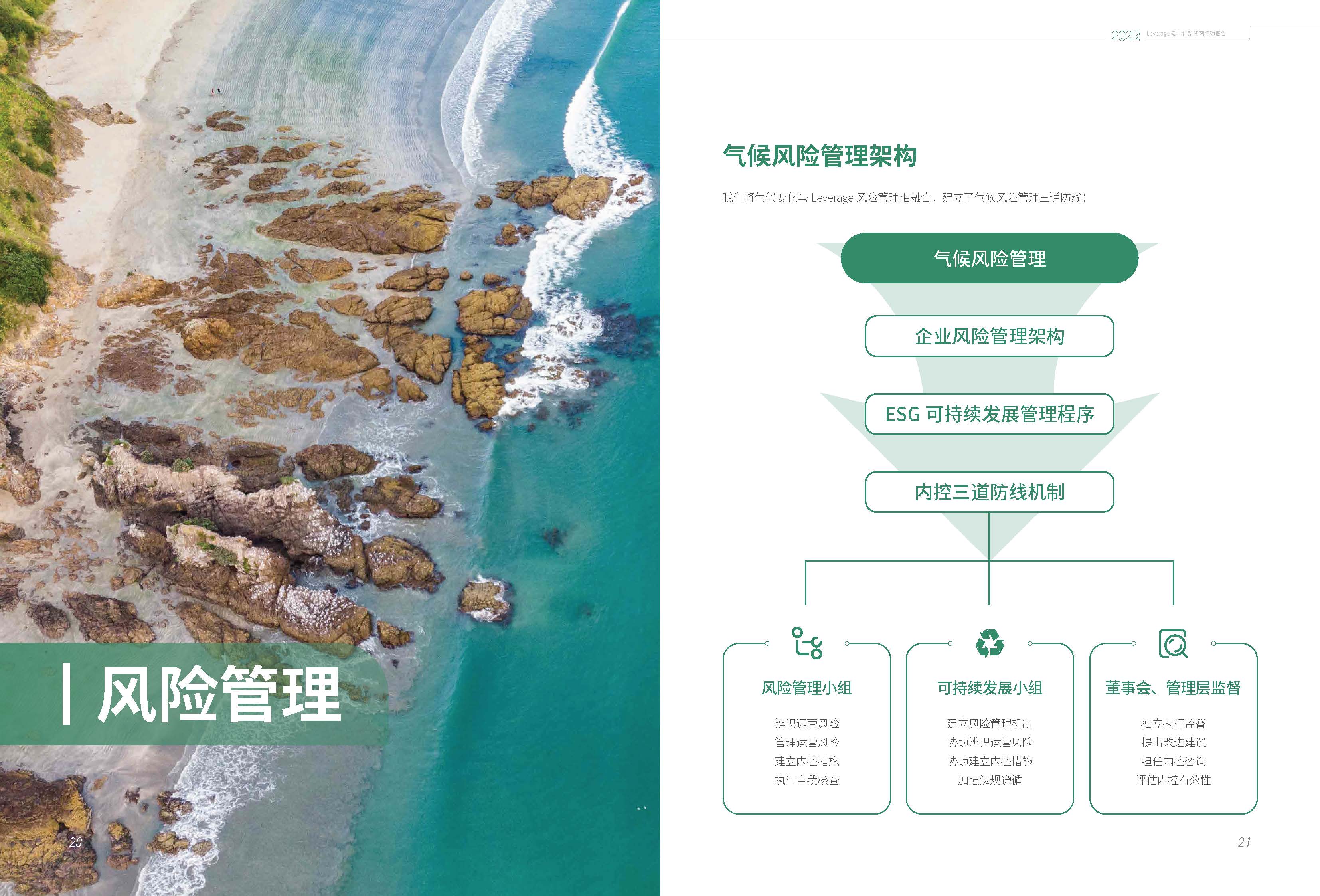

Leverage integrates climate change with risk management and establishes three lines of defense for climate risk management: The risk management team is responsible for identifying and managing operational risks, establishing internal control measures and conducting regular self-checks to realize the control of operational risks; The Sustainable Development Team is responsible for establishing the risk management mechanism, assisting the risk management team to identify and control all risks in the business process, and improving internal control measures according to relevant laws and regulations to ensure the smooth operation of business activities; Finally, the board of directors and the management shall be responsible for the supervision, put forward suggestions for improvement of the work of the above two groups, and serve as the internal control consultant to evaluate the effectiveness of existing internal control measures and guide the improvement.

Leverage has established an enterprise risk management mechanism. Each process has a clear organization, responsibility and function to ensure the effective operation of the risk management mechanism.

Leverage joined The Science Based Target Initiative in 2022, setting short-term targets and net-zero targets along The streamlined route for SMEs.

According to the report, Leverage the total greenhouse gas emissions in 2022 decreased by 26.87% compared to 2021, It is expected that by 2030, the short-term goal will be achieved, with emissions falling by 42% year-on-year, and by 2035, it will finally achieve net zero emissions.

Leverage has set short - and long-term targets for the proportion of renewable energy used, with 2021 as the base year. In 2023, we will take stock of the renewable energy solutions that can be implemented by the company, compare the long-term benefits of self-use/rental, and determine the priority and investment point of each solution. Rooftop photovoltaics are expected to be installed in 2028, generating 20% of demand by 2030 and 95% of electricity demand by 2035. The remaining target value will be met through the purchase of international or domestic green certificates, In order to ensure that the net zero emissions target can be achieved on time.

In the future, Leverage will continue to focus on environmental sustainability issues, strengthen greenhouse gas emission management, and mitigate the impact of climate change. As a professional technical services company, we take a pragmatic approach to environmental sustainability, integrate environmental, social and governance themes into our daily operations and business activities, and strive to develop more products and services to support climate action, use their services and influence to drive climate action across the supply chain for brands and retailers.

About this report

Time lasts from:

January 1, 2022 to December 31, 2022.

Reference standards for preparation:

Task Force on Climate-related Financial Disclosures, TCFD

IFRS S2 Climate-related Disclosures

This report is our first time to disclose according to the standards of TCFD and IFRS S2. If there is any deficiency, we will be more than welcome to hear from you

Reliability assurance

The information and data disclosed in this report are derived from Leverage official documents, including statistical reports, annual reports, sustainable development reports, etc.

Suggestion and feedback

If you have any comments, suggestions or questions about this report, please contact us as follows:

Address: Room M02, Building 2, 1328 Hengnan Road, Minhang District, Shanghai, P.R. China, 201114

Tel:+86 21 64067720

Email:spg@leveragelimited.com

How to get this report

Click here to download the full report

If not necessary, please try to use electronic reports to save resources and protect our planet

If you want to know more information, please contact us:

■ Shanghai :

Leverage Limited (Shanghai) Co., Ltd.

Address: Room 402, No 2. Building, No .1328, Hengnan Rd, Shanghai, China

Phone: + 86 21 64067720

Email: cs@leveragelimited.com

■ Hongkong :

Leverage Global Limited

Address: Room 1318-19, Hollywood Plaza, 610 Nathan Road, Mongkok, Kowloon, Hong Kong

【Contact Us】

Tel:

+86 21 64067720

Email: info@leveragelimited.com