Analyzing the Importance of ESG Report Verification from the Mistakes of Nongfu Spring ESG Report

With the arrival of 2023, the compilation and release of corporate CSR/ESG reports has also ushered in a peak stage.

Recently, the latest richest company in China, the well-known Chinese company Nongfu Spring, released an ESG sustainable development report that sparked a huge discussion in the circle of friends;

http://www.nongfuspring.com/sustainability.html

Nongfu Spring has just released its ESG report for 2021. Because Nongfu Spring is listed on the Hong Kong Stock Exchange, its ESG report is written in accordance with the ESG disclosure requirements of the Hong Kong Stock Exchange.

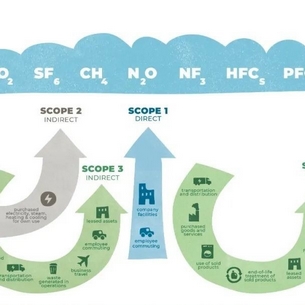

According to the report, Nongfu Spring has won honors such as National Green Factory and National Green Supply Chain Management Enterprise. Nongfu Spring also has some practical cases in the fields of water conservation and carbon emissions. However, in terms of water conservation and carbon emission reduction, Nongfu Spring only set relative indicators such as emission intensity, but did not set absolute emission reduction targets.

There is no absolute emission reduction target, which means that if Nongfu Spring’s business continues to expand in the future, its total emissions will continue to increase. There is no absolute value reduction target, enterprises can establish carbon peak and carbon neutral goals based on the scientific carbon target SBTi, and guide enterprises to practice climate change actions from a development perspective and a strategic height.

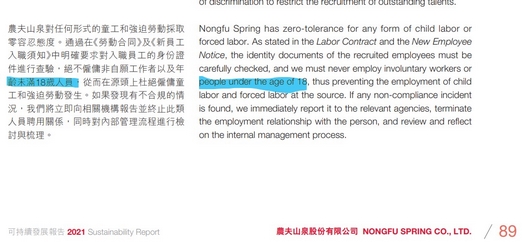

There is also an obvious mistake in the report. The editor of the report probably wanted to explain that the company does not employ child labor, but he/she obviously did not understand whether the age definition of child labor is 16 or 18. The report blatantly stated that it refuses to recruit employees under the age of 18, but our national labor law stipulates that employees aged 16-18 can be recruited. Such small mistakes reflect Nongfu Spring’s lack of understanding of labor laws and its unprofessional social responsibility module; this is also a portrayal of the current ESG “overheating” phenomenon;

Many so-called ESG professionals talk about ESG without even being familiar with and mastering the knowledge of Social Social Responsibility in ESG.

As an organization focusing on ESG training, report compilation and verification, Leverage would like to tell you the importance of ESG report content and data compliance;

ESG reporting verification can help companies communicate while reducing the risk of non-compliance;

If Nongfu Spring has invited a professional third-party organization to conduct the verification of the report, this kind of mistake will definitely be identified and corrected;

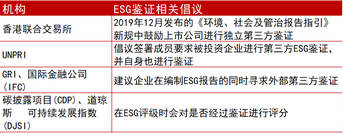

From December 2019, the Hong Kong Stock Exchange issued the "Environmental, Social and Governance Reporting Guidelines" to encourage listed companies to conduct independent third-party ESG verification of their ESG reports.

The Current State of ESG Assurance

As of December 31, 2021, there were 4,681 A-share listed companies, of which 1,412 companies disclosed the 2021 ESG report, with a disclosure rate of 30%. However, there are only 54 companies with certified ESG reports, and the certified rate is 3.8%.

In contrast, the disclosure rate of independent ESG reports of Hong Kong stocks is relatively low (109, corresponding to 4.26%), but 69 companies have been certified, and the certification rate exceeds 63%.

In the sci-tech innovation board of the subdivision of listed companies, 95 sci-tech innovation board companies have separately disclosed ESG reports, but have not certified ESG reports. Therefore, they are still a blank market for ESG assurance business.

Definition of ESG Assurance

According to the definition of IAASB (International Standards on Auditing and Forensics), ESG report forensics means that the forensics service provider states a conclusion on a forensics object (such as the key data disclosed in the ESG report) according to the forensics work criteria, so as to enhance the degree of trust of the expected users other than the responsible party on the output results of the forensics object.

In order to avoid conflicts of interest, the assurance service provider should be a third-party professional organization, so that effective assurance can ensure the impartiality and reliability of its reports.

With the increasing intensity of corporate ESG information disclosure, regulators and asset managers have begun to focus on the reliability of information disclosure, and ESG third-party assurance has received more attention.

Table: Financial Institutions and Their Related Initiatives on ESG Assurance

The Significance of ESG Assurance

As the importance of ESG-related performance continues to emerge, investors and stakeholders have higher expectations for reliable, consistent and high-quality ESG information and data, requiring that the information and data in ESG reports stand up to scrutiny.

We found that more and more companies are actively seeking independent third-party organizations to verify their ESG reports.

Employing a third-party institution to verify an enterprise's ESG report can improve the credibility and transparency of the information and data disclosed in the ESG report, effectively improve the credibility and transparency of the ESG report (or its key data), help listed companies to more effectively disclose ESG information and improve the quality of ESG information disclosure, so as to better respond to the concerns of stakeholders such as foreign investors, and to help investors and other prospective users of the report obtain ESG information more effectively.

On the other hand, ESG assurance can also help companies review the information disclosure process and content from the perspective of an independent third party to ensure quality.

Listed companies can clarify the disclosure caliber of ESG data, judge whether the ESG-related internal control system design is rigorous, whether the control activities are effectively implemented, and whether there are loopholes in the current management system, strengthen the collection and management of ESG data and information, and standardize the ESG work management process, improve management loopholes, accelerate the establishment of an ESG management system, strengthen corresponding risk management, and improve the overall risk management level.

In April 2021, the European Commission adopted the draft of the Corporate Sustainability Reporting Directive (CSRD), which puts forward mandatory audit requirements for ESG disclosure information.

In March 2022, the U.S. SEC also put forward a consultation draft to enhance the standardization of climate disclosure, requiring companies to disclose scope 1 and scope 2 emission data to be verified and certified by an independent third party.

The proportion of listed companies around the world that provide assurance for ESG information continues to rise.

Which international standards are ESG reports based on?

Currently more authoritative standards and guidelines include: AA1000 compiled by ISEA (Social and Ethical Accountability Association), and ISAE3000 compiled by IAASB (International Auditing and Assurance Standards Board). Among them, AA1000 is the first authoritative verification standard with ESG information disclosure as the main body, and has a wider scope of application. Since the promulgation of this standard, the number of international companies conducting verification according to this standard and issuing ESG verification reports has gradually increased.

Shanghai Leverage Supply Chain Management Co., Ltd. has been approved as an AA1000 sustainable development (ESG) report verification agency. Leverage will cooperate with AccountAbility to provide professional verification services in the disclosure of sustainable information and corporate responsibility information, so as to provide customers with confidence in coping with sustainable development challenges and investors' scrutiny.

Advantages of AA1000AS V3 Effective Application

► Draw conclusions on the quality, rigor, and consistency of the organization's overall management practices, as well as performance on the four AA1000AP (2018) principles of inclusiveness, materiality, responsiveness, and impact.

► Assist reporting organizations in obtaining assurance on overall sustainability performance, including scope of management and reporting, through the application of AA1000AP (2018)

► Ensure that the reporting organization's objectives, disclosures and sustainability management are stakeholder-centred.

► Provides proven and internationally recognized sustainability assurance methodologies.

► Complement other international and national assurance standards and frameworks.

► Compatible with other international, national, sectoral and/or theme-driven sustainability-related standards, frameworks and guidelines.

► Build trust and credibility for the reliability and quality of disclosures reporting on an organization's sustainability performance.

► Generate externally assured information to effectively support governance practices, organizational decision-making and risk management.

Verification Process

It is expected that enterprises will pay attention to the accuracy of content and data while telling the story of corporate ESG practice, so as to avoid unnecessary trouble and loss;

Leave the professional work to professional people, and let us work together to tell the "ESG" story of Chinese companies.

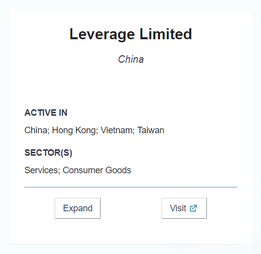

Leverage is a clean, transparent and responsible third-party supply chain management service company. A member unit of the Life Cycle Green Management Professional Committee, as well as a member unit of many international organizations such as UNGC, UNEP, AWS, SAI, etc. As an AA1000 sustainable development (ESG) report verification agency, Leverage will use the professional knowledge of its own team to provide professional verification services for corporate sustainability reports.

ISO Management System Certification | Service Certification | Product Certification | Product Inspection and Testing Service | Enterprise ESG Strategy Consulting | ESG Report Preparation | OCI Marine Plastic Recycling Certification | Carbon Verificaion for Enterprises | Carbon Footprint Verificaion for Product | Carbon Neutrality Project Customization

If you want to know more information, please contact us:

■ Shanghai :

Leverage Limited (Shanghai) Co., Ltd.

Address: Room 402, No 2. Building, No .1328, Hengnan Rd, Shanghai, China

Phone: + 86 21 64067720

Email: cs@leveragelimited.com

■ Hongkong :

Leverage Global Limited

Address: Room 1318-19, Hollywood Plaza, 610 Nathan Road, Mongkok, Kowloon, Hong Kong

【Contact Us】

Tel:

+86 21 64067720

Email: info@leveragelimited.com